TAL Education Group (TAL, Financial) has recently experienced a notable drop in its stock price, with a daily loss of 4.19% and a three-month decline of 10.38%. Coupled with an Earnings Per Share (EPS) (EPS) of $0, the question arises: is TAL significantly overvalued? This analysis delves into TAL Education Group's current market valuation to provide investors with a clearer picture. Keep reading to understand the nuances of its intrinsic value.

Company Overview

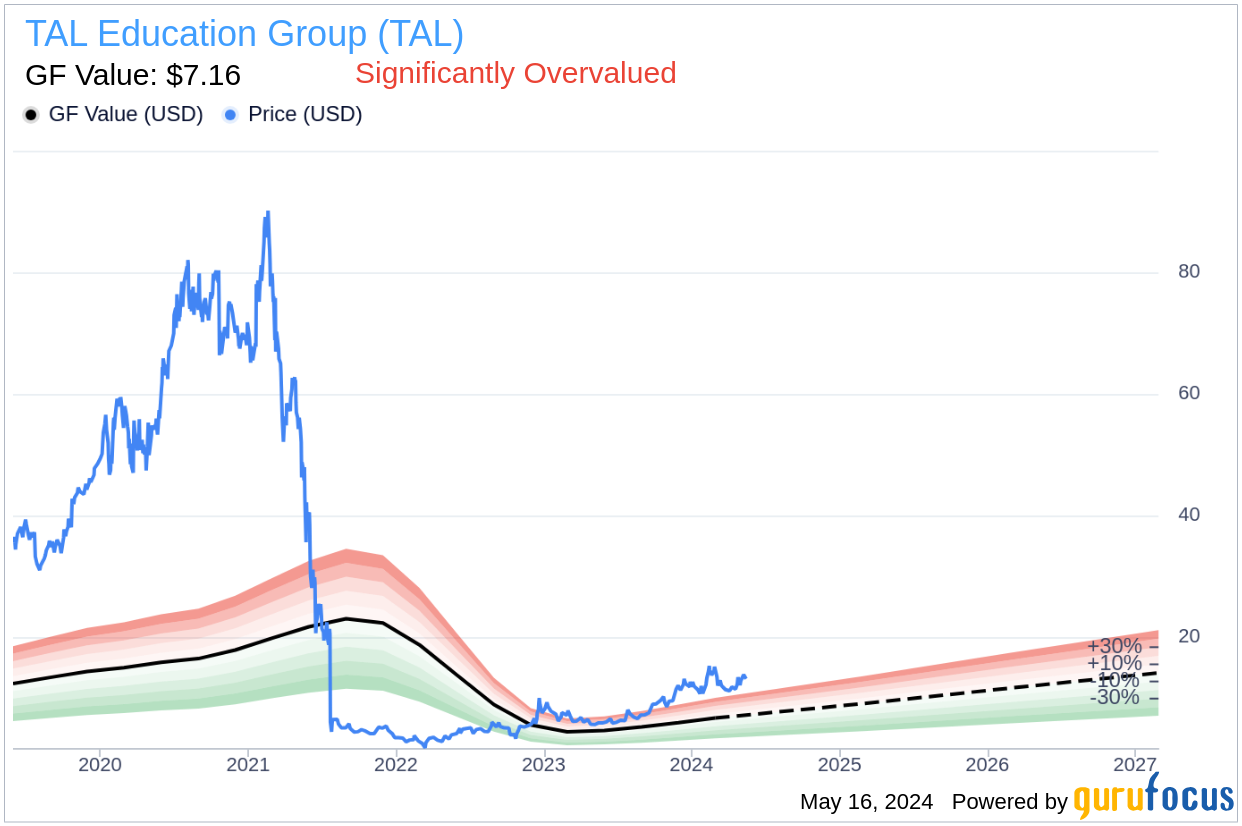

TAL Education Group is a prominent provider of smart learning solutions in China, having pivoted from K-9 academic afterschool tutoring to focus on enrichment learning and content solutions after regulatory changes in 2021. This strategic shift invites a reassessment of its valuation, especially in light of its current stock price of $12.57 against a GF Value of $7.16, suggesting a significant overvaluation. Here's a breakdown of the company's income sources:

Understanding GF Value

The GF Value is a proprietary measure calculated by GuruFocus to estimate the fair intrinsic value of a stock. It incorporates historical trading multiples, a unique adjustment factor from past performance and growth, along with future business performance expectations. For TAL, the GF Value suggests that the stock is significantly overvalued at its current price. This discrepancy indicates potential poor future returns relative to the company's growth unless the market adjusts the valuation.

Financial Strength and Stability

Assessing the financial strength of TAL Education Group is crucial to understanding its risk of capital loss. The company boasts a cash-to-debt ratio of 13.81, ranking better than 77.86% of its peers in the education sector. This favorable ratio, combined with a fair financial strength rating of 7 out of 10, suggests a stable financial base. Below is a visual representation of TAL's debt and cash over recent years:

Profitability and Growth Prospects

Despite being profitable in 5 out of the past 10 years, TAL Education Group's profitability is considered fair, with an operating margin that ranks lower than 75.95% of its industry counterparts. The company's 3-year average annual revenue growth rate of -30.8% also positions it unfavorably within the education sector. These figures highlight challenges but also underscore the importance of strategic realignment and market adaptation.

ROIC vs. WACC: A Critical Comparison

Comparing TAL's Return on Invested Capital (ROIC) of -0.5 to its Weighted Average Cost of Capital (WACC) of 4.4 reveals that the company is currently not generating adequate returns on its investments, which is a red flag for potential investors. The historical comparison of ROIC versus WACC is depicted below:

Conclusion

In conclusion, TAL Education Group's stock appears to be significantly overvalued based on its current GF Value, with financial metrics that suggest caution. Investors should consider these factors carefully and monitor the company's strategic adjustments and market conditions. For more detailed financial insights on TAL Education Group, you can view its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, explore the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.